Saving money is a vital aspect of financial stability and security. Whether you’re trying to build an emergency fund, pay off debt, or simply want to have more disposable income, implementing effective money-saving strategies can make a significant difference. In this article, we’ll explore various tips to help you save money and improve your financial well-being.

Create a Budget:

Begin by tracking your income and expenses.

Categorize your spending to identify areas where you can cut costs.

Allocate a portion of your income to savings or investments.

Cut Unnecessary Expenses:

Identify discretionary spending, such as dining out or subscription services.

Reduce or eliminate expenses that don’t contribute to your well-being.

Consider cooking at home, canceling unused subscriptions, and buying generic brands.

Shop Smart:

Look for sales, discounts, and coupons when making purchases.

Compare prices and read reviews before buying products or services.

Consider buying in bulk or from wholesale stores for cost savings.

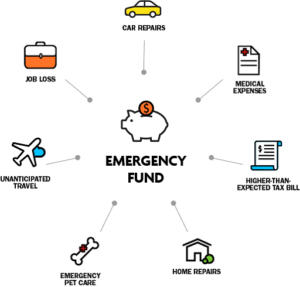

Create an Emergency Fund:

Aim to save at least three to six months’ worth of living expenses.

Having an emergency fund can prevent you from going into debt in unexpected situations.

Automate Savings:

Set up automatic transfers from your checking account to your savings or investment accounts.

This ensures that you consistently save a portion of your income.

Negotiate Bills:

Contact service providers and negotiate for better rates on utilities, cable, internet, and insurance.

Loyalty to a company can sometimes be leveraged for discounts.

Reduce Transportation Costs:

Use public transportation or carpool to save on fuel and maintenance costs.

Consider walking or biking for short trips to cut down on transportation expenses.

Save on Energy:

Make your home more energy-efficient by sealing drafts and using energy-efficient appliances.

Set your thermostat to an optimal temperature to reduce heating and cooling costs.

Limit Impulse Purchases:

Practice delayed gratification by waiting 24 hours before making non-essential purchases.

You may find that many impulse buys aren’t as appealing after some time has passed.

Use Cashback and Rewards:

Utilize credit cards that offer cashback or rewards on your everyday purchases.

Be sure to pay off your credit card balance each month to avoid interest charges.

DIY Projects:

Learn to tackle simple home repairs and improvements yourself.

Avoid hiring professionals for tasks you can do with a little effort and research.

Plan Meals and Reduce Food Waste:

Create weekly meal plans and grocery lists to avoid eating out unnecessarily.

Use leftovers creatively to minimize food waste.

Invest Wisely:

Learn about investment options and consider diversifying your portfolio.

Consult with a financial advisor to make informed investment decisions.

Consider Refinancing Loans:

Explore options for refinancing high-interest loans or mortgages to lower your monthly payments.

Lower interest rates can save you a substantial amount over time.

Track Your Progress:

Regularly review your budget and financial goals.

Celebrate your achievements and adjust your strategies as needed.

Saving money requires discipline, but it’s a crucial step toward achieving your financial goals. By implementing these tips, you can gradually build wealth, reduce financial stress, and enjoy a more secure future. Start small, stay consistent, and watch your savings grow over time. Remember, every penny saved brings you one step closer to financial freedom.